How Liquidation Affects Business Owners and Directors

When a company faces financial distress and can no longer pay its debts, liquidation is often the final step. But what does liquidation mean for the people behind the business — especially its owners and directors?

Understanding the legal, financial, and reputational impacts of liquidation on directors is crucial to navigating this difficult time and minimising personal risk.

What Is Liquidation?

Liquidation is the formal process of winding up a company’s affairs. A registered liquidator takes control of the business, sells off its assets, pays creditors (as much as possible), and deregisters the company.

Impact on Business Owners

1. Loss of Ownership and Control

Once a company enters liquidation, its directors and shareholders lose control of day-to-day operations and decision-making. The appointed liquidator takes over all company matters.

2. Financial Loss

Owners may lose:

Equity invested in the business

Future profits

Personal assets (if they’ve signed personal guarantees)

3. Reputational Impact

Being associated with a failed business can affect future ventures, funding opportunities, and stakeholder trust.

Impact on Company Directors

1. Director Disqualification Risk

Under the Corporations Act 2001, directors can be disqualified from managing corporations for up to 5 years if:

They’ve been involved in multiple failed companies

They’ve breached their duties

There’s evidence of illegal phoenix activity

2. Director Penalty Notices (DPNs)

The ATO can issue a DPN for unpaid PAYG withholding, GST, or superannuation. In some cases, this can make directors personally liable for company tax debts if they fail to act in time.

Tip: If you receive a DPN, immediate action (such as entering into Small Business Restructuring or voluntary liquidation) may limit personal liability.

3. Potential for Legal Action

If directors continue trading while the company is insolvent, they could face:

Civil penalties

Criminal charges

Compensation claims

4. Scrutiny of Conduct

The liquidator is legally required to investigate the directors’ conduct, especially in the lead-up to insolvency. This includes:

Reviewing company transactions

Assessing the use of company funds

Identifying uncommercial or preferential payments

5. Restrictions on Future Business

While liquidation does not automatically ban directors from starting new companies, repeat involvement in failed businesses raises red flags and may lead to credit difficulties or regulatory limits.

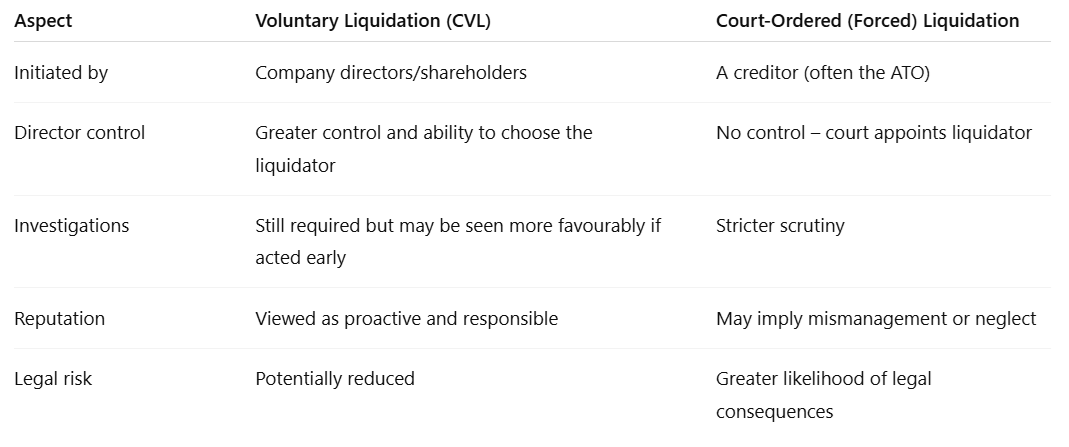

Voluntary vs Forced Liquidation: The Director’s Perspective

How to Minimise Risk as a Director

Act early if you notice cash flow or tax debt issues.

Engage an insolvency professional before creditors escalate action.

Keep proper financial records and comply with ATO lodgement obligations.

Consider a Small Business Restructure (SBR) or Safe Harbour protection before opting for liquidation.

Conclusion

Liquidation is a serious step with lasting consequences for business owners and directors. While it often marks the end of a business, it doesn’t have to be the end of your professional future. By understanding the implications and acting early, directors can limit personal exposure, protect their reputation, and start fresh with better safeguards in place.

References

ASIC: Insolvency for Directors – Liquidation

ATO: Director Penalty Notice (DPN)

Corporations Act 2001 (Cth), ss 588G, 206F

Australian Government Treasury – Insolvency Reforms