Voluntary Liquidation vs. Forced Liquidation: What’s the Difference?

When a company becomes insolvent or no longer serves its purpose, liquidation may be necessary. However, not all liquidation processes are the same. In Australia, there are two key types: Voluntary Liquidation and Forced (Court-Ordered) Liquidation. Understanding the differences between the two is critical for company directors and creditors.

What Is Liquidation?

Liquidation is the formal process of winding up a company’s affairs, selling off its assets, and distributing any remaining funds to creditors. Once completed, the company is deregistered and ceases to exist.

Voluntary Liquidation

Definition:

A voluntary liquidation is initiated by the company’s directors and shareholders when they decide that the company can no longer continue operating — either because it is insolvent or because the shareholders want to close the business for other reasons.

Types of Voluntary Liquidation:

Creditors' Voluntary Liquidation (CVL): The company is insolvent and unable to pay debts.

Members' Voluntary Liquidation (MVL): The company is solvent but chooses to wind up (e.g., retiring owners).

Process:

Company directors resolve to liquidate.

Shareholders vote on the resolution.

A registered liquidator is appointed.

Liquidator realises assets and distributes funds to creditors.

Benefits:

Directors have more control over the process.

Can avoid court proceedings and public stigma.

Potentially lower costs than court-ordered liquidation.

Shows directors are acting responsibly and proactively.

Forced (Court-Ordered) Liquidation

Definition:

Also called involuntary liquidation, this occurs when a creditor applies to the court to wind up a company that has failed to pay its debts.

Process:

A creditor (often the ATO) issues a statutory demand.

If the company fails to comply within 21 days, the creditor can apply to the Federal Court or Supreme Court for winding up.

A liquidator is appointed by the court.

Risks and Consequences:

Court action may result in additional legal costs.

Directors lose control over the process.

Greater reputational damage to the business and its directors.

Possible director penalties or investigations into director conduct.

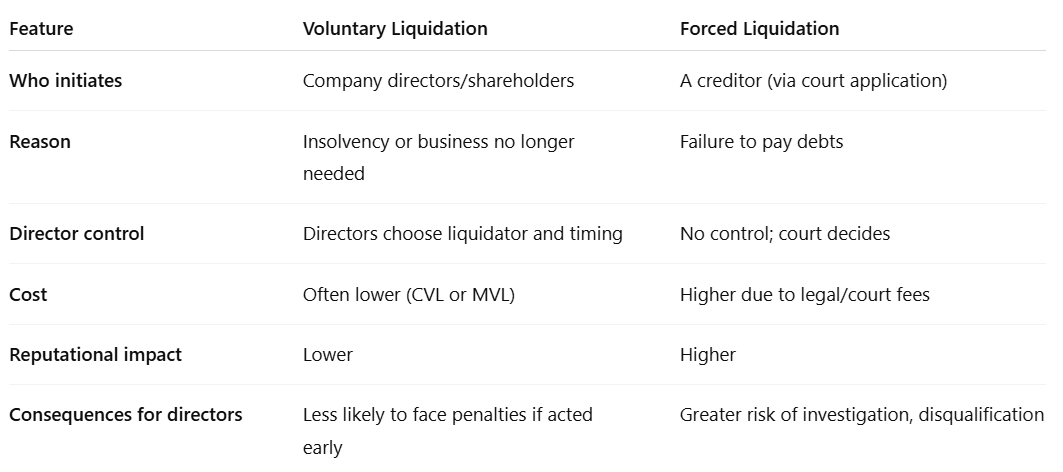

Key Differences Between Voluntary and Forced Liquidation

Why Acting Early Matters

Choosing a voluntary liquidation when your business is struggling financially gives you more control and may protect you from personal liability — especially if you’ve received a Director Penalty Notice (DPN) or other enforcement action from the ATO.

Waiting too long increases the chance of forced liquidation, which can lead to director disqualification, legal scrutiny, and greater financial consequences.

Final Thoughts

If your business is no longer viable, it’s important to understand the liquidation options available to you. A voluntary approach is generally more strategic and less damaging than a court-imposed one. Getting advice from a qualified insolvency practitioner early can help you protect your personal and professional future.

References

Australian Securities & Investments Commission (ASIC) – Liquidation

Australian Government Treasury – Insolvency Reforms

ATO – Insolvency and director responsibilities

Australian Restructuring Insolvency and Turnaround Association (ARITA) – Understanding liquidation

Federal Court of Australia – Winding up applications