Can a Director Start a New Business After Liquidation?

In most cases, yes.

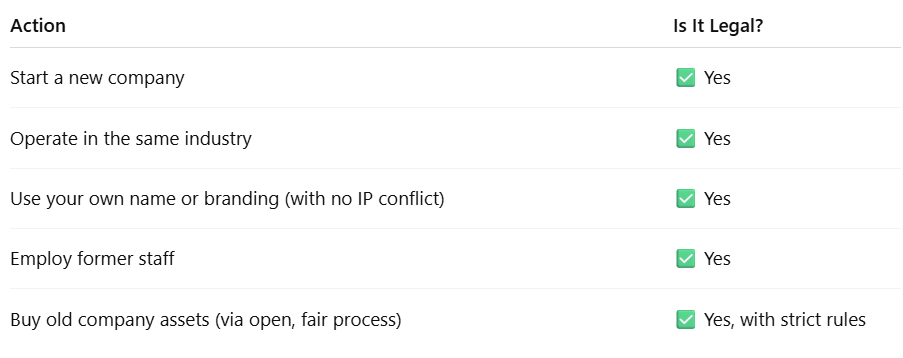

Australian law does not prohibit directors of a liquidated company from starting a new business or even a business in the same industry. However, the new company must be genuinely independent of the old one, and the process must be legal and transparent.

What You Can Do After Liquidation

What You Cannot Do (Illegal Phoenix Activity)

Illegal phoenix activity occurs when a director deliberately liquidates a company to avoid debts (especially ATO and employee entitlements), then starts a new business that’s essentially the same — often transferring assets without paying creditors.

Illegal actions include:

Transferring assets from the old company to the new one without fair market value

Using the same business name or branding to confuse creditors or customers

Avoiding outstanding debts or obligations intentionally

Under the Corporations Act 2001, ASIC and the ATO have powers to investigate and prosecute illegal phoenix behaviour, including civil and criminal penalties.

How to Restart a Business Legally

1. Wait Until Liquidation Is Finalised

You must wait for the liquidator to complete the process, which includes:

Selling company assets

Paying creditors

Investigating director conduct

Deregistering the company

2. Do Not Transfer Assets Privately

If you want to purchase old company assets (equipment, domain names, etc.), they must be:

Valued at market rates

Purchased through the liquidator

Fully documented with a payment trail

3. Avoid Deceptive Similarities

Even if legal, using:

The same name

Identical branding

Same website or contact details

can look suspicious. This could lead to ASIC scrutiny and claims of misleading conduct.

4. Maintain Proper Records

If you do restart, ensure:

Full financial transparency

Proper tax lodgements

Employee entitlements paid on time

Are There Restrictions for Directors?

Some directors may be disqualified from managing companies for up to 5 years under Section 206F of the Corporations Act if:

They’ve been involved in multiple failed companies

Mismanaged company funds

Traded while insolvent

Always check your status with ASIC before registering a new business.

Alternative: Consider a Small Business Restructure (SBR) Before Liquidation

If your company is still trading but under financial stress, consider Small Business Restructuring (SBR) as an alternative. It allows you to:

Legally restructure ATO and other unsecured debts

Continue trading

Avoid liquidation and director penalties

Conclusion

Yes, you can restart a business after liquidation — but do it ethically and legally. Consult with a registered liquidator or restructuring professional before taking action. Avoid shortcuts, as illegal phoenixing can lead to severe penalties, including director bans and criminal charges.

References

ASIC: Illegal Phoenix Activity

Treasury: Phoenixing Offences Legislation

Corporations Act 2001 (Cth), Sections 206F, 588G

ATO: Illegal Phoenix Activity

ARITA: Restarting After Insolvency