What Happens If I Don’t Comply with the SBR Plan?

If you don’t comply with a Small Business Restructure (SBR) plan, there can be serious legal and financial consequences. Here's a full breakdown of what happens, the risks, and what directors and business owners need to know.

What Happens If You Fail to Comply with an SBR Plan?

1. The Plan May Be Terminated

If the company misses payments or fails to meet the obligations outlined in the approved restructuring plan, the Small Business Restructuring Practitioner (SBRP) can terminate the plan.

This can happen without creditor consent if you clearly breach the plan.

Creditors can also apply to court to terminate the plan if they believe there's been non-compliance or fraud.

Source: Corporations Act 2001 (Cth), s 455K; s 453H

2. Directors Can Be Exposed to Personal Liability

If the plan fails and the company still owes unpaid PAYG withholding, GST, or superannuation, directors could become personally liable via a Director Penalty Notice (DPN).

An SBR plan does not erase prior obligations for directors under tax law.

If the company is wound up after the plan fails, the ATO may pursue directors directly for these debts.

Source: ATO – Director Penalty Regime, Link

3. Creditors Can Pursue the Company Again

Once the plan is terminated, creditors regain their legal rights to chase the debts owed to them, including:

Issuing statutory demands

Starting legal proceedings

Applying for liquidation

The stay on creditor actions only applies while the SBR plan is valid and being complied with.

4. The Company May Be Forced into Liquidation

If the plan fails, and the company has no viable alternative, liquidation becomes the default pathway. This could lead to:

Business closure

Asset sales to repay creditors

Public insolvency notices via ASIC

5. Loss of Creditor Trust

Even if the business continues, a failed SBR plan damages your credibility. Creditors, suppliers, and lenders may:

Tighten terms

Refuse credit

Terminate supply agreements

How to Avoid Failing the SBR Plan

Work with a reputable restructuring practitioner

Be realistic about your ability to meet repayments

Stay transparent with your adviser and act early

Track and adjust cash flow to meet plan obligations

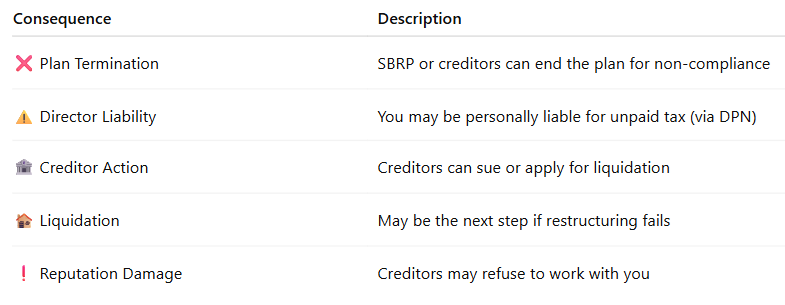

Summary Table

References

Corporations Act 2001 (Cth), Sections 453H, 455K

ATO: Director Penalty Regime