How Public Is a Small Business Restructure? Will My Customers Know?

Great question — a Small Business Restructure (SBR) is not very public, especially compared to other insolvency processes like liquidation or voluntary administration. Here's a detailed explanation:

Will the Public Know About My SBR?

It’s a Low-Profile Process

One of the major benefits of an SBR is its discretion. Unlike liquidation or voluntary administration — which are often publicly announced and carry a stigma — the SBR process is quieter:

Do Customers or Suppliers Find Out?

Only if you tell them.

There’s no legal requirement to notify your customers, clients, or the public. Most business relationships will remain unaffected unless they do a deep search on ASIC records or credit databases (which is rare in day-to-day dealings).

Exceptions:

If you rely on major contracts with large suppliers, they might run periodic checks.

Trade credit insurers may pick up the ASIC appointment.

Do Employees Find Out?

Again, not automatically. You are not legally required to inform staff unless their employment arrangements change (e.g. reduced hours, layoffs). But if you're restructuring due to financial hardship, open communication may help retain staff trust.

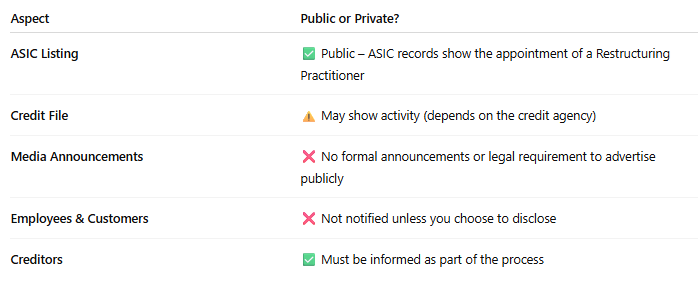

What Is Public?

ASIC Website – Will show a notice of the appointment of a Small Business Restructuring Practitioner.

Credit Reports – May reflect that your business is undergoing restructuring.

Creditors – Must receive a formal plan and vote on it.

Key Benefits of SBR Privacy

Preserve business reputation

Avoid panic from suppliers or clients

Maintain operations as usual

No court involvement or media coverage

References

Corporations Act 2001 – Part 5.3B

Australian Restructuring Insolvency & Turnaround Association (ARITA)