What Are Director Penalty Notices (DPNs) and How Do They Work?

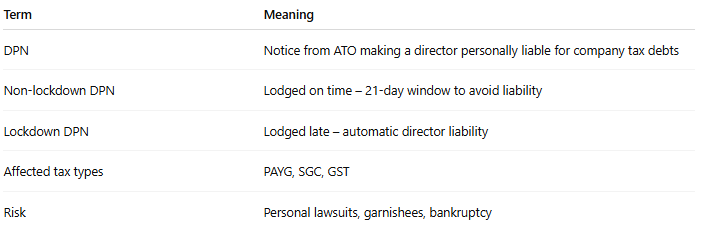

When a company falls behind on its tax obligations, directors can’t simply walk away. In Australia, the Director Penalty Notice (DPN) regime gives the Australian Taxation Office (ATO) power to hold company directors personally liable for certain tax debts. Understanding how DPNs work—and the risks involved—is critical for anyone in a director role.

What Is a Director Penalty Notice (DPN)?

A Director Penalty Notice is a formal notice issued by the ATO to a current or former company director, making them personally liable for unpaid company tax debts.

DPNs apply to:

PAYG withholding (Pay As You Go)

Superannuation Guarantee Charge (SGC)

GST (since 2020)

If these debts remain unpaid and unreported, the ATO can issue a DPN to directors, making them personally liable even if the company goes into liquidation or administration.

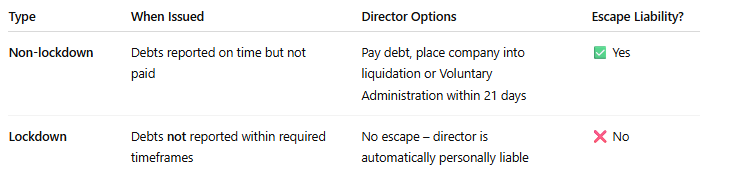

Types of Director Penalty Notices

There are two types of DPNs: Non-lockdown and Lockdown. Each has different rules and consequences.

Lockdown DPN Example:

If a company fails to lodge its BAS or Superannuation Guarantee Statement within 3 months of the due date, directors receive a lockdown DPN. There is no ability to avoid liability.

Who Can Receive a DPN?

All current directors

Former directors (if the debt arose during their time in office)

Newly appointed directors (if debts were due before their appointment and remain unpaid 30 days after they join)

How the DPN Process Works

Company fails to pay PAYG, GST or SGC

ATO identifies overdue amounts and issues a DPN

DPN is sent to director’s registered address (no email – must be in writing)

The director has 21 days to act (for non-lockdown DPNs)

If no action is taken:

ATO can begin legal recovery (garnishee orders, personal asset seizure)

The director becomes personally liable for the debt

How to Avoid or Mitigate a DPN

Lodge BAS and superannuation statements on time – even if you can’t pay

Act quickly when receiving a DPN – speak to a restructuring or insolvency professional immediately

Consider entering a Small Business Restructure (SBR) or voluntary administration to resolve the debt before DPN liability locks in

Keep detailed records and maintain financial oversight

Legal Consequences of Ignoring a DPN

The ATO can sue the director personally

Credit ratings can be affected

Bankruptcy proceedings may follow if the director can't repay the debt

Directors may be disqualified for failing to meet obligations

DPNs and Small Business Restructuring

Directors with DPNs may still be able to restructure the business using the Small Business Restructure (SBR) framework if they act quickly—ideally before a lockdown DPN is issued. Timing is key.

References

ATO: Director Penalty Regime

Corporations Act 2001 (Cth), s 269-25 and s 269-15