Small Business Restructure (SBR) vs. Liquidation: What’s the Difference?

Introduction

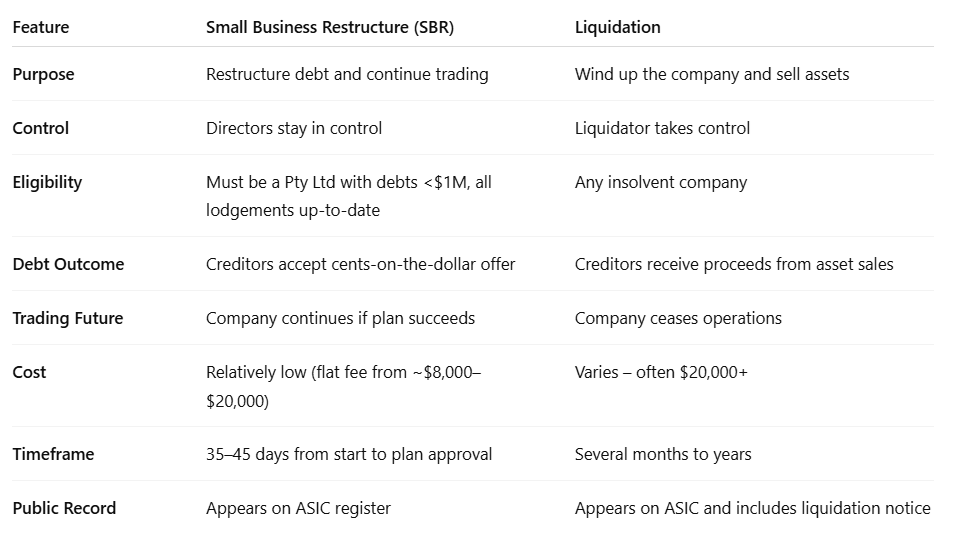

When a company is struggling with mounting tax debts or cash flow issues, directors are often faced with two serious options: Small Business Restructure (SBR) or Liquidation. While both are formal insolvency processes under Australian corporate law, they are fundamentally different in outcome, control, and long-term impact.

This article will break down the key differences between SBR and liquidation, helping you understand which one may be right for your situation — and why acting early is critical.

At a Glance: Key Differences Between SBR and Liquidation

What Is a Small Business Restructure (SBR)?

The Small Business Restructure is a streamlined debt restructuring process introduced by the Australian Government in 2021 to support viable small businesses experiencing temporary financial distress.

It allows companies to work with a Small Business Restructuring Practitioner (SBRP) to propose a formal repayment plan to creditors — often reducing ATO and other debts by up to 70% — while continuing to trade under director control.

✅ Best for: Companies that are viable but drowning in ATO debt, super or supplier bills.

What Is Liquidation?

Liquidation is the formal winding up of a company that is insolvent and cannot pay its debts. A registered liquidator is appointed to:

Sell all assets

Investigate director conduct

Distribute proceeds to creditors

Deregister the company

Once liquidation begins, directors lose control and the company is permanently shut down.

✅ Best for: Businesses that are no longer viable, with no realistic chance of recovery.

How to Choose Between SBR and Liquidation

Ask yourself:

Is the business fundamentally viable?

If yes → SBR may be a better optionAre all tax returns and BAS up to date?

If yes → You’re likely eligible for SBRAre you still trading or generating income?

If yes → Restructure might help you stay openIs the company already facing legal action or a wind-up notice?

If yes → Liquidation might be more appropriate

Advantages of SBR Over Liquidation

Retain your business and keep trading

Avoid the stigma of liquidation

Save staff and customer relationships

Restructure debt legally and transparently

ATO generally supports SBR over forced wind-ups

Warning Signs You’re Headed Toward Liquidation

Company owes over $100k in ATO debt

Received a Director Penalty Notice (DPN)

Superannuation is unpaid

Creditors are issuing statutory demands

Bank account has been frozen by the ATO

What to Do Next

Don’t wait until liquidation is your only option. Directors who act early have more tools and flexibility — especially with the SBR process.

Speak to a licensed Small Business Restructuring Practitioner (SBRP) today for a confidential review of your situation.

References

Australian Securities and Investments Commission (ASIC) – Restructuring and the Restructuring Plan

Corporations Amendment (Corporate Insolvency Reforms) Act 2020 (Cth)

Australian Restructuring Insolvency & Turnaround Association (ARITA) – Insolvency Types Explained

Australian Government Treasury – Insolvency Reforms to Support Small Business