What to Do if You Receive a Director Penalty Notice (DPN)

Understand your obligations, options, and how to act fast to avoid personal liability

What Is a Director Penalty Notice?

A Director Penalty Notice (DPN) is a legal notice issued by the Australian Taxation Office (ATO) that can make directors personally liable for certain unpaid company tax debts.

These debts typically include:

PAYG (Pay As You Go) withholding

Superannuation Guarantee Charge (SGC)

Goods and Services Tax (GST)

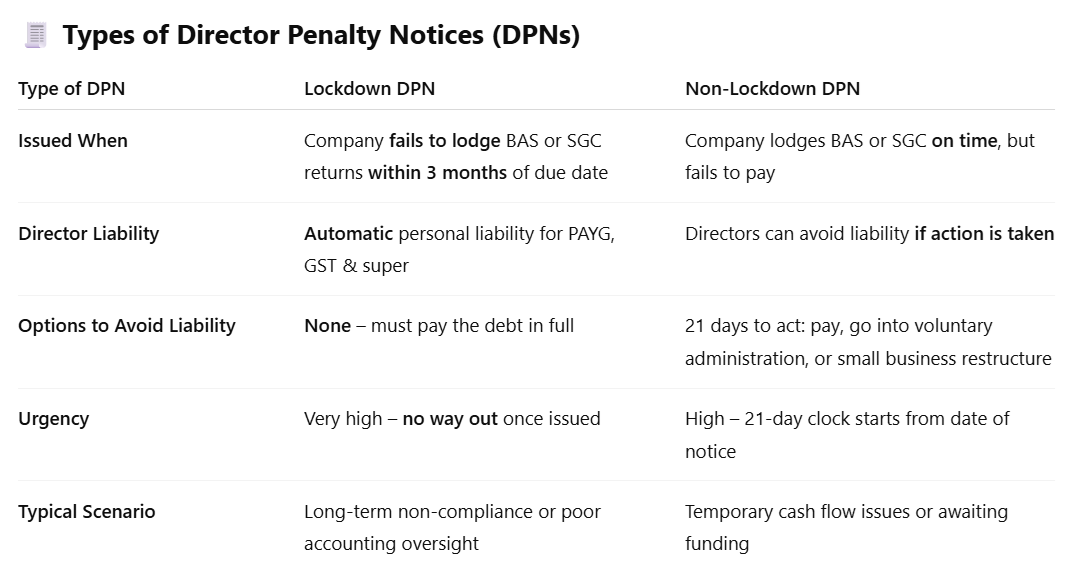

Key Timeframes

PAYG & GST: BAS must be lodged within 3 months of the due date

SGC: Superannuation Guarantee Charge Statement must be lodged by the due date

Failure to lodge on time triggers a Lockdown DPN – no way to avoid personal liability

What Happens If You Ignore a DPN?

If no action is taken within the 21-day timeframe:

The ATO may begin personal recovery proceedings

Garnishee notices may be issued to your bank accounts or clients

The ATO may initiate legal proceedings against you personally

It may affect your credit file, assets, and future directorship eligibility

What to Do Immediately

If you receive a DPN:

1. Don’t Panic — But Don’t Delay

The 21-day clock starts ticking from the date of the notice, not the day you open it.

2. Check If It’s Lockdown or Non-Lockdown

This determines whether you still have options to restructure, liquidate or pay.

3. Seek Expert Advice

Contact a registered insolvency practitioner or accountant who specialises in DPN responses.

4. Explore the Small Business Restructure (SBR) Option

If your business is viable, an SBR may help reduce the tax debt and allow you to avoid personal liability under a Non-Lockdown DPN.

How the Small Business Restructure Can Help

If the DPN is Non-Lockdown, a Small Business Restructure allows your business to:

Propose a repayment plan to creditors, including the ATO

Continue trading while reducing tax debt

Appoint a Small Business Restructuring Practitioner (SBRP) to formalise the plan

Avoid liquidation and save your directorship

This must be initiated within 21 days of receiving the DPN to protect yourself.

Key Takeaways

A DPN is a serious warning sign – not just for your company, but your personal finances

Directors can be personally liable for tax debts if they ignore DPNs or fail to act quickly

The type of DPN determines your available options

You may still save your business (and personal liability) with expert guidance and fast action

References

Australian Taxation Office – Understanding Director Penalty Notices

Corporations Act 2001 (Cth) – Part 5.3B

Taxation Administration Act 1953 – Section 269-15 to 269-45

Australian Restructuring Insolvency & Turnaround Association (ARITA) – DPN Information Sheets

Treasury – Insolvency Reforms to Support Small Business