What Happens to Employees in Liquidation?

When a company goes into liquidation, the effects extend beyond the business and its creditors — employees are often among the most impacted. Understanding what happens to employee entitlements and rights during liquidation is crucial for both employees and business owners.

This article explains the process, the rights of employees, and how they may recover unpaid wages and entitlements when their employer is liquidated in Australia.

What Is Liquidation?

Liquidation is a formal insolvency process where a company’s operations are wound up, its assets sold off, and proceeds distributed to creditors. A registered liquidator is appointed to manage the process.

When a company enters liquidation, it usually ceases to operate, and employees are terminated unless the liquidator decides to trade the business for a short time.

Are Employee Entitlements Protected?

Yes — in many cases, employee entitlements are protected, either through the liquidation process or via government assistance.

Employee claims are considered a priority over many other unsecured creditors under the Corporations Act 2001.

What Employee Entitlements Are Covered?

Employees may be entitled to recover the following:

How Are Employees Paid?

Through Liquidation

The liquidator will assess available assets and distribute funds. Employee entitlements are paid before unsecured creditors but after secured creditors (e.g. banks with registered security).Through the Fair Entitlements Guarantee (FEG)

If there are insufficient funds in the liquidation, eligible employees may claim unpaid entitlements from FEG, administered by the Federal Government.

What Is FEG and How Does It Work?

The Fair Entitlements Guarantee (FEG) provides financial assistance to employees who’ve lost their job due to liquidation or bankruptcy of their employer.

FEG Eligibility:

You may be eligible if:

You were an Australian citizen or permanent resident

You lost your job due to liquidation or bankruptcy

You lodged a claim within 12 months

What’s Not Covered?

Superannuation – You must lodge a complaint with the Australian Taxation Office (ATO).

Contractor claims – Independent contractors are not covered by FEG.

Shareholder employees – Employees who were directors or shareholders may not qualify for FEG.

Employee Rights During Liquidation

Employees have the right to:

Be notified of their termination

Lodge a proof of debt with the liquidator

Claim through FEG if eligible

Seek unpaid super from the ATO

Request written details of entitlements owed

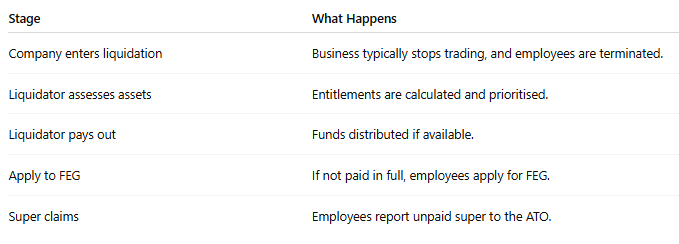

What’s the Process for Employees?

What Should Employers Know?

If you're a director, you have a legal duty to ensure employee entitlements are met.

Attempting to avoid these obligations can lead to personal liability or director disqualification.

Liquidation may relieve the company of debt, but employee claims still must be addressed.

Final Thoughts

Employee entitlements are one of the most sensitive aspects of liquidation. While the Fair Entitlements Guarantee offers support, the process can still be distressing for affected workers.

Employers and directors should always seek professional insolvency advice early to avoid escalation and ensure compliance with employment law.

References

Corporations Act 2001 – s556

Fair Entitlements Guarantee (FEG) – Australian Government

ASIC – Employee entitlements and liquidation

ATO – Recover unpaid superannuation