How Liquidation Affects Directors Personally

When a company enters liquidation, directors are often left wondering how the process will affect them personally. While company debts are typically separate from personal liabilities, there are several critical circumstances where directors can be held personally responsible or face legal consequences.

This article explains the key personal impacts on directors during liquidation in Australia and how to protect yourself before and during the process.

What Is Liquidation?

Liquidation is the formal process of winding up a company’s affairs, selling off assets, and distributing the proceeds to creditors. A registered liquidator is appointed to take control, investigate the company’s affairs, and ensure all legal obligations are met.

Are Directors Personally Liable for Company Debts?

Generally, no — company debts remain the responsibility of the company (a separate legal entity). However, directors can be personally liable in certain situations.

Here are the key ways directors can be affected:

1. Insolvent Trading

Under Section 588G of the Corporations Act 2001, directors must not allow a company to incur debts while insolvent. If it’s proven that the company was insolvent and you knew (or should have known), you can be held personally liable for some or all of those debts.

Tip:

Early action and seeking professional advice can help avoid this risk.

2. Director Penalty Notices (DPNs)

The ATO can issue a DPN to directors for unpaid:

PAYG withholding

Superannuation Guarantee Charge (SGC)

GST (as of April 2020)

If a DPN is issued and the company’s tax obligations are not resolved in time, the director becomes personally liable for those debts.

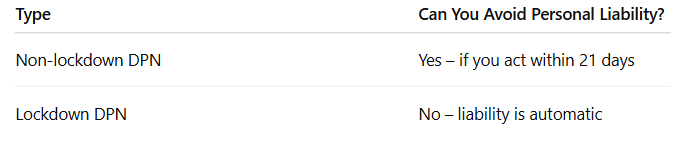

There are two types:

3. Uncommercial Transactions

If directors have authorised payments, asset transfers, or loans to related parties when the company was insolvent or near insolvent, the liquidator may claw back these transactions. Directors can also face civil penalties.

4. Personal Guarantees

If you’ve personally guaranteed company loans, leases, or supplier accounts, liquidation does not absolve your personal responsibility. The lender can pursue your personal assets for repayment.

5. Failure to Keep Proper Records

ASIC requires directors to maintain accurate financial records. If a liquidator finds that proper records were not kept, you could face civil penalties, bans from being a director, or prosecution.

6. Director Disqualification

ASIC may disqualify a director from managing corporations for up to 5 years if:

You were a director of two or more failed companies within 7 years

The companies had unpaid debts (including ATO or employee entitlements)

How to Minimise Personal Risk in Liquidation

Seek Professional Help Early

Engage a registered liquidator or insolvency expert as soon as financial distress is evident.

Ensure Tax Lodgements Are On Time

Even if you can’t pay, lodge BAS and super to avoid a lockdown DPN.

Keep Accurate and Up-to-Date Records

Good documentation can protect you from accusations of misconduct.

Avoid Last-Minute Transactions

Don't transfer assets, pay back director loans, or gift company property.

Communicate With Creditors Honestly

Transparency often reduces hostility and legal action.

FAQs: What Directors Should Know

Can I start another business after liquidation?

Yes – unless you’ve been disqualified by ASIC.

Will liquidation affect my personal credit score?

No – unless you have personal guarantees or court judgments.

Can I be banned from being a director?

Yes – if ASIC finds repeated failures or misconduct.

Summary

Liquidation doesn’t automatically mean personal ruin for directors. However, ignoring responsibilities, delaying action, or breaching your duties can turn a corporate issue into a personal liability nightmare.

Early advice, clean records, and compliance with tax obligations are your best defences.

References

Corporations Act 2001 – Section 588G

ASIC – Liquidating a Company

ATO – Director Penalty Regime

ASIC – Being a Company Director