Refinancing vs. SBR: Which Is Right for Your Business?

When your business is facing mounting tax debt or financial pressure, it's critical to understand your options. Two common strategies are refinancing and the Small Business Restructure (SBR) process. Each has its place—depending on your business’s financial health, structure, and long-term goals.

This guide compares both approaches, helping you make an informed decision.

What Is Refinancing?

Refinancing involves taking out a new loan to pay off existing debts. For businesses, this could mean:

Business loans to cover ATO tax debt

Invoice financing or line of credit

Consolidation loans from private lenders

✅ Advantages of Refinancing:

Immediate cash injection

Preserves company control (no formal process required)

Loan interest is tax-deductible

🚫 Disadvantages:

You must qualify for the loan (credit checks, servicing requirements)

Can worsen cash flow if repayments are high

Does not reduce the original tax debt – just restructures it

What Is a Small Business Restructure (SBR)?

SBR is a formal government-backed insolvency solution introduced in 2021. It allows eligible small companies to legally restructure and reduce debts, including ATO tax debt, without going into liquidation.

✅ Advantages of SBR:

Reduces eligible debts by up to 70–80%

Directors remain in control of the business

Creditors are bound by the plan if the majority approve

No upfront court proceedings or liquidation required

🚫 Disadvantages:

Available only once every 7 years

You must meet strict eligibility criteria (e.g., less than $1M in liabilities, tax lodgements up to date)

Creditors must vote to approve the plan

It becomes a matter of public record (via ASIC)

When to Choose Refinancing

Refinancing is a strong option if:

Your business is profitable or stable but facing short-term pressure

You have good credit or strong financials

You want to avoid formal insolvency pathways

You prefer to keep your financial difficulties private

Pro Tip: Use refinancing to clear ATO debt before interest becomes non-deductible (from July 2025 onward, ATO interest will no longer be tax deductible).

When to Choose SBR

SBR may be a better fit if:

Your business has ATO debt over $80,000

You've received Director Penalty Notices (DPNs) or payment demands

You're behind on super, GST, PAYG

Cash flow is tight and you cannot qualify for a loan

You want to legally reduce the total debt owed

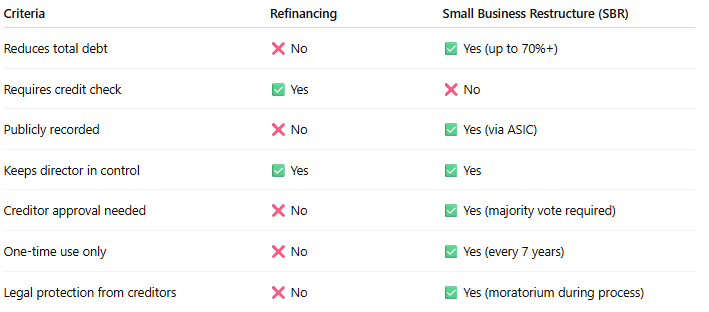

Refinancing vs. SBR at a Glance

Final Thoughts

Both options have their place. If you're still solvent and can handle repayments, refinancing may provide a fast and quiet solution. But if the pressure is mounting and debt is growing unmanageable, SBR offers a formal path to resolution with real financial relief.

References

Australian Government – Treasury: Insolvency Reforms for Small Business

ATO: Refinancing business debt

Australian Financial Security Authority (AFSA): Business insolvency explained