Can Creditors Reject an SBR Plan?

Yes — creditors can reject a Small Business Restructuring (SBR) plan, and their decision is a critical part of whether the restructure succeeds or fails.

Below is a comprehensive guide explaining how creditor approval works, when and why a plan may be rejected, and what happens next if it is.

How Does Creditor Approval Work in an SBR?

When a company proposes a restructuring plan, it must be reviewed by a Registered Small Business Restructuring Practitioner. That practitioner then:

Confirms the company meets eligibility requirements.

Helps the directors develop a formal restructuring plan.

Issues a proposal statement to creditors with full details.

Creditors are then given 15 business days to vote on the plan.

To be approved:

The plan needs more than 50% in value of the voting creditors (by dollar amount), not by headcount.

Only unsecured creditors are eligible to vote (excluding related parties).

If this majority is not achieved, the plan is automatically rejected.

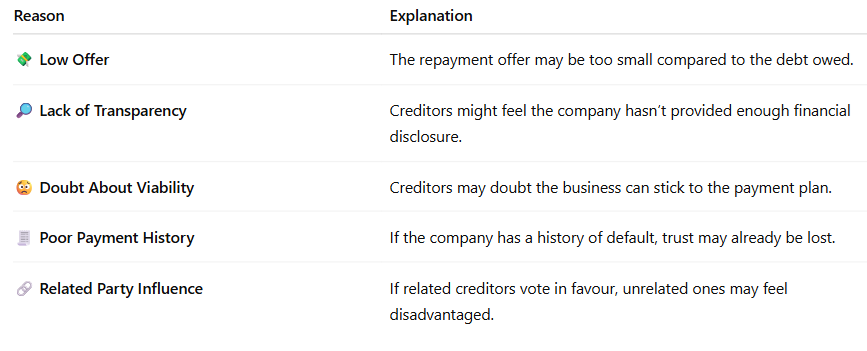

Why Would Creditors Reject a Restructuring Plan?

Creditors may vote against an SBR plan for several reasons:

What Happens If Creditors Reject the Plan?

If creditors reject the plan:

The company exits the restructuring process immediately.

The moratorium (protection against legal action) ends.

Creditors can resume enforcement actions (e.g., debt collection, legal proceedings, statutory demands).

The company may need to consider Voluntary Administration, liquidation, or negotiating payment plans directly.

Can the Plan Be Re-submitted?

Not under the same process.

If creditors vote the plan down:

The business would have to exit the current SBR process.

It cannot submit another SBR for 7 years under current legislation (unless exceptions apply).

Tips for Improving Approval Chances

Offer a realistic but attractive repayment percentage.

Work with an experienced restructuring practitioner who can communicate effectively with creditors.

Include a clear explanation of how the company will meet the plan’s terms.

Be transparent and proactive with creditor concerns.

Final Word

While SBR is a powerful tool, creditor approval is not guaranteed. Businesses need to put forward a strong, fair proposal, supported by robust financials, to earn creditor trust and secure a second chance.

References

Corporations Act 2001 (Cth), Part 5.3B

Australian Restructuring Insolvency & Turnaround Association (ARITA)