How Long Does the Small Business Restructure Process Take?

If your company is facing financial stress or ATO debt, you may be considering a Small Business Restructure (SBR) as a solution. But how long does the process actually take — and how quickly can you get relief?

Here’s a breakdown of the SBR timeline and what to expect at each stage.

What Is a Small Business Restructure?

The Small Business Restructuring (SBR) process, introduced under Part 5.3B of the Corporations Act 2001, allows eligible companies with debts under $1 million to formally restructure their debt with creditor approval — without appointing an external administrator to take over day-to-day control.

It’s designed to help viable businesses reduce debt and avoid liquidation.

Overview of the SBR Process

The Small Business Restructuring Process was introduced in January 2021 under Part 5.3B of the Corporations Act 2001. It’s a simplified form of restructuring designed for eligible small businesses with debts under $1 million, enabling directors to retain control while working with a registered restructuring practitioner (RP) to propose a plan to creditors.

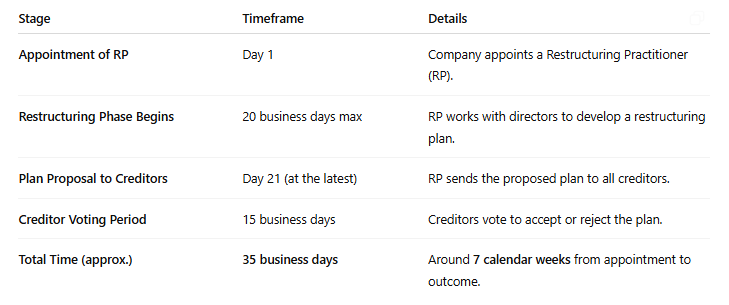

Typical Timeline of an SBR

Note: The RP can request an extension of up to 10 business days to develop the plan, making the maximum period 45 business days (~9 weeks), but this is rare.

Summary of Key Timeframes

Initial setup & documentation: ~3–5 days

Plan development & financial analysis: ~2–3 weeks

Creditor voting & plan decision: 3 weeks (including proposal delivery + 15 business day vote window)

Total estimated duration: 5–7 weeks from start to finish

What Can Delay the Process?

While the SBR is streamlined, delays can occur due to:

Incomplete or inaccurate financial records

Difficulty contacting creditors

Disagreements among directors

Needing legal or accounting advice mid-process

Working with an experienced RP and having up-to-date financials can minimise these delays.

When Does the Plan Begin?

If approved, the plan becomes binding on all unsecured creditors and begins immediately after the creditor voting period ends.

Typical payment terms under SBR plans range from:

3 to 24 months, depending on company cash flow

Can include lump sums, instalments, or milestones

Can You Start Sooner?

Yes — you can prepare your financials and consult with an RP in advance to streamline the process. Pre-engagement work can shorten the active timeline significantly.

Conclusion

The Small Business Restructure process generally takes 5 to 7 weeks from start to finish, with some flexibility depending on business complexity. Given the time sensitivity of ATO debt, director penalty notices (DPNs), or cash flow stress, starting early can make a significant difference.

References

Corporations Act 2001, Part 5.3B – Small Business Restructuring

Australian Government Treasury: Insolvency reforms to support small business

ATO: Support for businesses with tax debt