Will the SBR Plan Affect My Credit Rating?

If your business is struggling with tax debt or cash flow, a Small Business Restructure (SBR) might sound like a lifesaver — and it often is. But many directors worry: “Will this affect my credit rating?”

Here’s what you need to know.

What Is a Small Business Restructure?

The Small Business Restructuring (SBR) process, introduced under Part 5.3B of the Corporations Act 2001, allows eligible companies with debts under $1 million to formally restructure their debt with creditor approval — without appointing an external administrator to take over day-to-day control.

It’s designed to help viable businesses reduce debt and avoid liquidation.

Will an SBR Appear on My Credit Report?

For the Company:

The SBR process is recorded on the company’s public record, including the ASIC register.

Credit bureaus may pick up on this information — which can affect the company's commercial credit rating.

Financial institutions and trade creditors may view a company undergoing an SBR as higher risk.

For Directors (Personally):

An SBR does not affect your personal credit file (e.g. VedaScore/Equifax) unless:

You’ve provided personal guarantees on business debts.

You default personally on those guarantees.

So while your company’s credit rating may be impacted, your personal credit score is not automatically affected just by initiating an SBR.

Will It Impact Future Borrowing?

Yes — to an extent.

Some lenders may hesitate to extend new business credit to companies currently in (or recently emerged from) a restructuring plan.

This is especially true if the business has had past defaults or is flagged on commercial credit reports.

However, once a business completes the SBR successfully and remains compliant, creditworthiness can be gradually rebuilt.

Will Creditors or Clients Know?

The SBR is not as publicly visible as liquidation or voluntary administration. However:

Creditors are notified (they must vote on the plan).

Details may appear on commercial credit files and the ASIC Insolvency Notices website, which is public.

If maintaining business reputation is key, the SBR is often a far better option than external administration or insolvency.

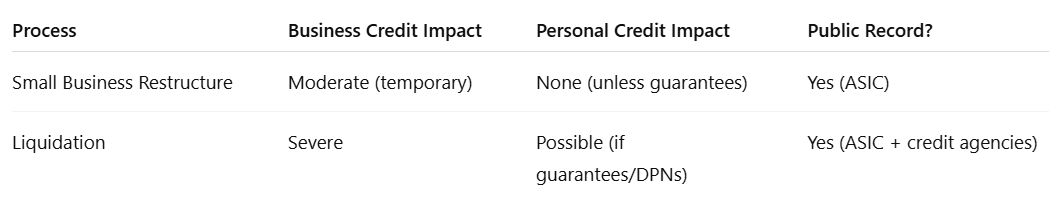

SBR vs Liquidation (Impact on Credit Rating)

Can You Rebuild Your Credit After SBR?

Absolutely. Many businesses use the breathing room from an SBR to:

Improve cash flow

Rebuild supplier trust

Avoid defaults going forward

Establish new credit under better terms once the restructure is complete

Conclusion

The Small Business Restructure plan may impact your business’s commercial credit rating, but it doesn’t automatically harm your personal credit score unless you’ve guaranteed business debts. Compared to insolvency, SBR is a less damaging, more recoverable path forward.

If your business has tax debt, struggling cash flow, or creditor pressure, it’s worth seeking early advice from a registered restructuring practitioner to understand your options.

References

Australian Securities & Investments Commission (ASIC) – Small Business Restructuring

Corporations Act 2001 – Part 5.3B

Australian Taxation Office – Support for Businesses with Tax Debt

Equifax Australia – Business Credit Reports