Does Small Business Restructuring (SBR) Affect My Credit Score or Business Credit File?

The Small Business Restructure (SBR) process, introduced by the Australian Government in 2021, allows financially distressed but viable companies to restructure their debts and avoid formal insolvency like liquidation or voluntary administration. But if you're a business owner considering SBR, you may be wondering:

"Will this affect my credit score or the company’s business credit file?"

Let’s explore this in detail.

Personal Credit Score – No Direct Impact

If you're a company director, SBR does not directly affect your personal credit score—as long as:

You’re not personally liable for the company’s debts (e.g. no personal guarantees or Director Penalty Notices),

You don’t have any outstanding personal defaults or insolvencies.

However:

If the company defaults on debts where you've signed personal guarantees (common with loans, leases, or supplier credit), those defaults can be listed on your personal credit file.

Tip: Before proceeding with SBR, review all director guarantees you’ve signed.

Business Credit File – Yes, It Can Be Impacted

The business credit report held by agencies like Equifax, CreditorWatch, and illion may reflect that the company has entered into a formal restructuring arrangement.

Here's how:

This information may affect the company’s ability to:

Get trade credit from suppliers,

Secure new loans or financing,

Win large contracts where financial stability is assessed.

However, once the plan is completed successfully, it shows creditors the business has addressed its debts and may improve long-term creditworthiness.

Key Considerations

Creditors can still report payment behaviour: If you fall behind on agreed SBR payments, it could lead to negative entries.

Transparency is essential: Being upfront with suppliers or lenders about your restructuring can maintain trust.

SBR is not a default: It’s a formal restructuring plan, not a winding-up or insolvency—but it’s still recorded.

Benefits of SBR Despite Credit Impacts

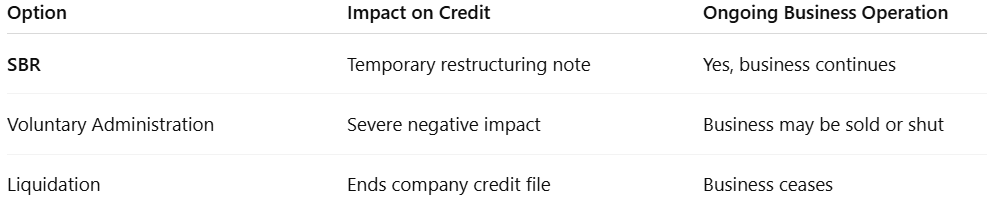

While SBR may temporarily affect the company’s credit file, it offers major advantages over alternatives:

Final Thoughts

Yes, Small Business Restructuring may appear on your business credit file, but it will not damage your personal credit score unless personal guarantees are triggered. Compared to the alternatives like liquidation, SBR offers a far more business-friendly outcome, especially for viable businesses aiming to survive and grow.

References

ATO: Support for businesses with tax debts

CreditorWatch: Business Credit Reports

Equifax: Understanding Business Credit

Treasury: Insolvency reforms for small business