What Are the Risks of a Small Business Restructure Failing?

A Small Business Restructure (SBR) is designed to give struggling companies a second chance by reducing or reorganizing their debts under a formal plan. But like any turnaround process, not all restructures succeed. Understanding the risks of failure is essential for business owners, directors, and advisers before entering the SBR process.

What Are the Risks if an SBR Fails?

1. Liquidation Is the Most Likely Outcome

If the SBR plan is not approved or fails during implementation, the company may have no choice but to enter voluntary liquidation. This results in:

Sale of business assets

Termination of staff

Directors losing control

Investigation of director conduct by the liquidator

2. Loss of Creditor Confidence

If creditors (especially the ATO) reject the SBR plan, it may indicate that they no longer believe the business is viable. This can:

Harm future negotiations

Increase the likelihood of winding-up applications

Damage the company’s long-term reputation

3. Directors May Face Personal Liability

If the restructure fails and the business is liquidated, directors may become personally liable for certain unpaid debts, such as:

Superannuation Guarantee Charge (SGC)

PAYG withholding (if DPNs were issued)

Debts personally guaranteed by the director

4. Legal and Administrative Costs

Even a failed restructure will involve fees for:

The Small Business Restructuring Practitioner (SBRP)

Legal or accounting advice

Lodgement and admin processes

These costs are typically non-refundable.

5. Damage to Business Reputation and Trust

Engaging in an SBR and failing to complete it can:

Affect relationships with suppliers and lenders

Signal financial instability to stakeholders

Result in loss of contracts or clients

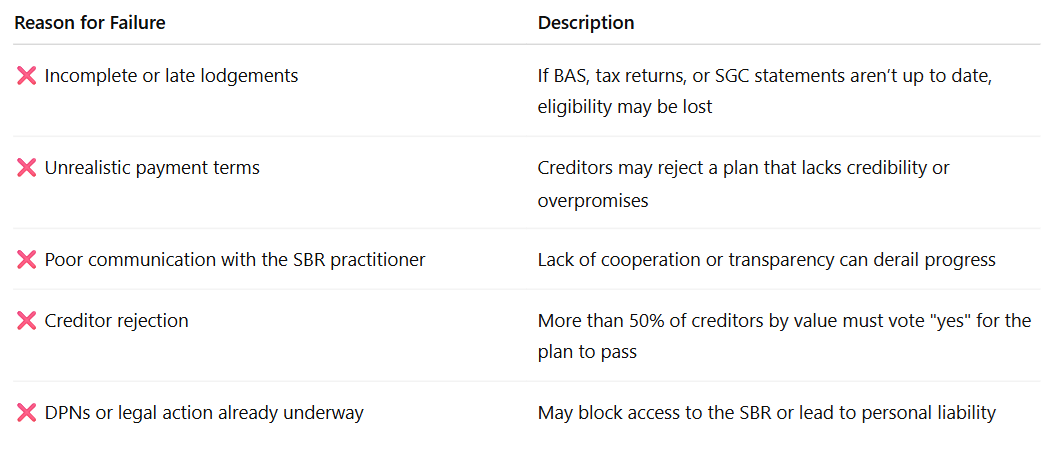

Common Reasons an SBR May Fail

How to Minimise the Risk

Engage early: Don’t wait until legal action or lockdown DPNs are issued

Stay compliant: Lodge all tax obligations and returns on time

Work with a qualified SBR Practitioner: They’ll guide you through the process

Be realistic: Don’t overpromise in the restructure plan

Stay transparent: Keep the SBRP and ATO informed throughout

Final Thought

While an SBR offers a legal and powerful tool for businesses with tax debt to survive, failure to follow through can have serious consequences — including liquidation and director liability. It’s essential to assess eligibility properly, act early, and get professional advice to ensure the best chance of success.

References

Australian Securities and Investments Commission (ASIC) – Restructuring and the restructuring plan

Australian Taxation Office (ATO) – Director Penalty Notice

Corporations Act 2001 – Part 5.3B: Small Business Restructuring